No matter how smart or experienced an investor may be, there is a multitude of psychological and social factors that affect their decisions.

Behavioral finance is an interdisciplinary study that dives into exactly that, exploring the psychology behind finance and digging deep into the reasons why people make irrational financial decisions.

The behaviour of money

The field has been around since the 1980s, but only came into mass popularity after the 2008 financial crisis.

Considered to be a relatively new field of study, behavioral finance arose by accident, as economists and professionals attempted to understand the psychology behind our financial decisions, noting that the conventional theory that the stock market moved in a predictable way, rational ways was, in fact, an inaccurate way of looking at investment.

Instead, behavioral finance notes that the financial market is full of inefficiencies, as it is largely influenced by flawed thinking on pricing and risk.

By studying cognitive psychology and behavioral economic models, researchers in the field found that investors often traded based on feedback models of other investors, rather than on any new information. This behaviour alone demonstrates the inefficiencies that conventional financial theories failed to explain or consider.

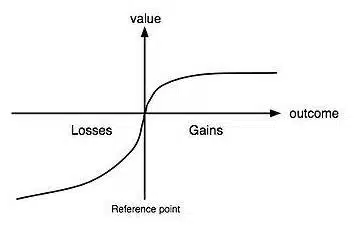

In 1979, two of the most prominent figures in behavioral finance and economics — Amos Tversky and Daniel Kahneman, published a paper titled Prospect Theory: An Analysis Of Decision Under Risk.

People make decisions based on the potential value of losses and gains rather than the final outcome.

— Amos Tversky & Daniel Kahneman

Amos Tversky, Daniel Kahneman, and Richard Thaler are considered to be the founding fathers of the field, each contributing their own ideas and thoughts to shaping behavioral finance into what it is today.

The cognitive biases that control us

When people are confronted with complex decisions, our brains often rely on mental shortcuts (also known as heuristics) to help us decide quickly. This is often the case when it comes to investment decisions.

The problem with this is that it can often lead to inaccurate beliefs and in turn, misguided judgments. This is what inevitably leads to what are called cognitive biases.

While there are a plethora of biases that affect the human mind and behaviour, some of the more common ones that affect investors include:

- Confirmation bias — This is the tendency for people to pay more attention to information that supports their prior beliefs and preconceived notions, ultimately leading to interpreting and recalling things selectively. In this social media age, where we all live in some form of echo chambers, we listen to or watch things that tend to agree with our beliefs. An investor that is subject to confirmation bias may not act on any information that contradicts his beliefs when investing.

- Familiarity bias — As the name implies, this is we prefer to stay in our comfort zones, refusing to act on anything that we are not familiar with. On a social level, we see this when it comes to people that only hang out with others of a similar race or nationality. When it comes to financial decisions, oftentimes, investors may only end up favoring familiar assets, hesitating to diversify, which leads to sub-par portfolios.

- Self-serving bias — Also known as the self-attribution bias, this is when people attribute successes to their own skills and efforts, disregarding luck or external forces. Yet, when it comes to bad results, they attribute it to bad luck or circumstance. When it comes to financial decisions, this can be dangerous as you fall into a sort of delusion, believing your choices can’t be or go wrong.

- Framing bias — This is when people make a decision based on how the information or data is presented, instead of the facts themselves. The saying ‘looking at the glass half full or half empty’ can echo this point, as the way we frame a specific situation is how we choose to react to it. When it comes to investing money, the way something is framed can lead to investors concluding whether it was good or bad.

Looking at the two options below, we see an example of the framing bias in effect:

- Option A) In Q2, we earned $120,000, compared to expectations of $125,000

- Option B) In Q2, we earned $120,000 compared to Q1, where we earned $115,000

As you can see, the earnings were the same amount, but Option B was framed in a way to be an improvement over the previous quarter. For anyone reading, B feels more positive.

How behavioral finance helps

Regardless of how calculated and experienced we may be with our finances, we’re all still human.

Even some of the smartest financial analysts and economists have made mistakes when it comes to investments. As humans, acting off of emotion is natural, and our brains — as much as we’d like to believe otherwise — are still not biologically programmed to deal with abstract concepts such as money.

To take emotion out of our decision-making process, you need to train yourself to maintain logical, methodical thinking and be reflective, instead of reactive or reflexive.

By becoming more aware of the psychological influences that define our decisions, and understanding more about our brain, investors can learn to be more cognizant of the biases that control us and avoid the costly mistakes of potentially foolish financial decisions.