As discussed in a previous article exploring our brains on money, we know that the concept of money itself is relatively new. As such, handling and managing it is a rudimentary skill for people in general.

The brain, no matter how advanced it is in its processes, still may have a few lapses when it comes to judgment when there is money at stake.

We know what happens to our minds when we lose a lot of money, but why is it that our brain makes bad investment decisions in the first place?

Heuristics that hinder us

The brain is not yet evolutionarily adapted to making decisions related to money.

In lieu of this, the brain may be limited in handling new information, which is what is thrown at investors almost every minute, with ever-changing stock prices and social changes affecting everything.

One limitation the brain experiences is something called anchoring — wherein our mind has a tendency to stick to the first piece of information we have, despite being shown new sources.

This may explain the issues that arise in our investment decisions. Upon being presented with new conditions in investment, the brain may stick to the old analyses, instead of crafting a new strategy.

In addition to this, the brain is geared to learn through repetitive experiences, allowing the individual to expect similar outcomes from the same set of conditions. The problem with this mindset is that it is not appropriate in the investment field – where outcomes are much less predictable.

This effect itself is known as the representativeness heuristic, where the brain assumes the likelihood of a particular outcome due to misguided assumptions which appear accurate, but in fact, are false.

For example, people may invest in a company that is profitable from the outside. But this is not always the case. What we see on the outside does not represent true value and investing in something based on appearance alone can be quite irrational.

Another trick our brain plays on us is the overconfidence effect, where our subjective confidence in our judgments is far greater than the actual accuracy of those judgments alone. This, together with the desire to win in a highly volatile market, is a bad combination that can result in poor investment decisions.

This unearned confidence, together with the desire of the person to win in a highly volatile market, is a bad combination that can result in investment decisions where you may lose much more.

A common example of this is when first-time investors earn their first gain in the stock market or foreign exchange. From this single win, they assume the choices they made were great and hold on to their investment, hoping that it will win more.

Avoiding uncertainty and loss

When we feel uncertain, we begin to experience stress and anxiety.

This is, even more, the case when we are dealing with high stakes of money. The more we are unsure of what will happen with such large stakes of money, the more stressed out we become, and the higher the stress, the worse our decisions are.

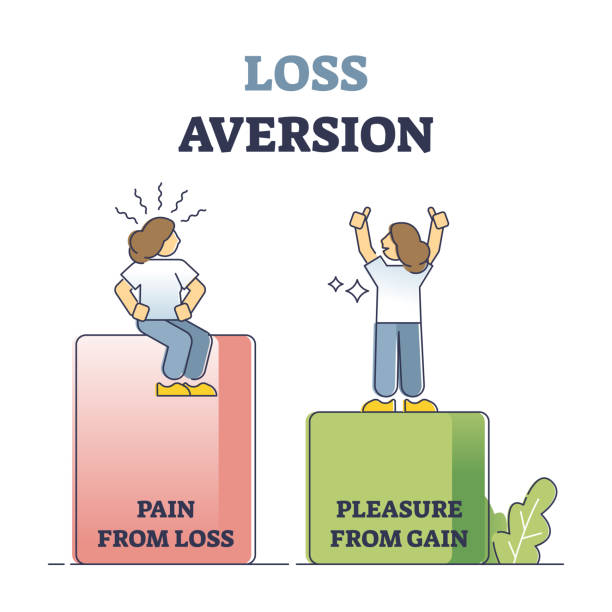

Financial gains may induce a sort of dopamine hit, but when it comes to financial loss, our brains experience the same sensations of pain. In order to avoid such pain, we make poorly thought-out financial decisions.

The loss aversion effect is when we are more willing to take risks simply to avoid a loss than to make gains. According to economists and psychologists, the very thought of losing is psychologically twice as powerful as the pleasure of gaining.

The problem with the human brain is that it does not accept loss easily. It tries to wiggle its way through a winning approach — regardless of if that strategy is inaccurate or bad. Our brains try to justify the approach taken, attempting to predict variables that might simply be unpredictable.

Humans are biologically not risk-takers

Back before money existed, and all of this modern innovation and technology was nowhere to be found, humans lived out in the wild where survival was not easy. You had to hunt for your food, at risk of being attacked by unknown diseases and animals. Back then, anything and everything could potentially kill you.

As such, it was only natural that the humans that took less risk out in the natural world would be more likely to live and survive, reproducing their genes and passing it on to the next generation.

While that may be all good and well for the continuation of the human race, what it inevitably led to is a natural selection of genes that promote an apprehension of risk. In other words, we are biologically programmed to not be risk-takers.